How it works

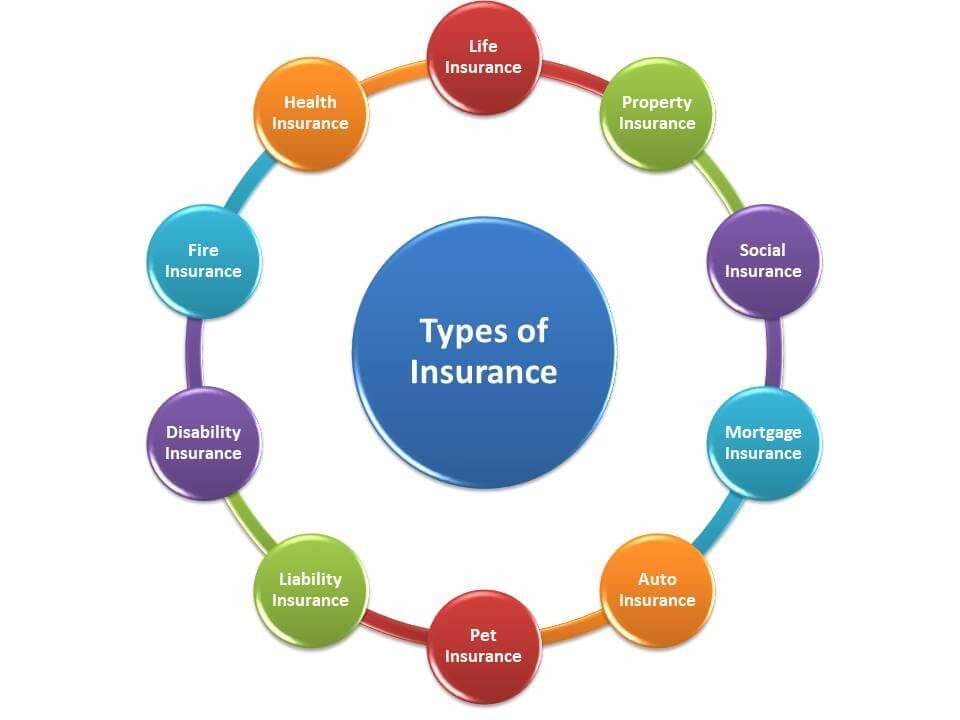

Types of Insurance Coverage

Car insurance is required for everyone who drives. In fact, it is required by law in the majority of states. When you purchase vehicle insurance, you are purchasing a policy. Your policy is determined by a number of factors, including the type of vehicle you drive and the type of insurance you desire. Auto insurance policies are basically a collection of various sorts of coverage.

The first step in comprehending a vehicle insurance policy is to become familiar with the various types of coverage available from insurance companies. Some of this coverage may be mandatory in your state, while others may be optional.

- Liability – This coverage pays for accidental bodily injury and property damages to others. Injury damages include medical expenses, pain and suffering and lost wages. Property damage includes damaged property and automobiles. This coverage also pays defense and court costs. State laws determine how much liability coverage you must purchase, but you can always get more coverage than your state requires.

- Collision – This coverage pays for damages to your vehicle caused by collision with another vehicle or object.

- Comprehensive – This coverage pays for loss or damage to the insured vehicle that doesn’t occur in an auto accident. The types of damages comprehensive insurance covers include loss caused by fire, wind, hail, flood, vandalism or theft.

- Medical Coverage – Pays medical expenses regardless of fault when the expenses are caused by an auto accident.

- PIP – Personal Injury Protection (PIP) is required in some states. This coverage pays medical expenses for the insured driver, regardless of fault, for treatment due to an auto accident.

- Uninsured Motorist – Pays your car’s damages when an auto accident is caused by a driver who doesn’t have liability insurance.

- Underinsured Motorist – Pays your car’s damages when an auto accident is caused by someone who has insufficient liability insurance.

- Rental Reimbursement – This type of coverage will pay for a rental car if your car is damaged due to an auto accident. Often this coverage has a daily allowance for a rental car.

Many insurance policies provide a combination of these sorts of protection. Knowing the laws in your state is the first step in choosing the insurance you want for your car. This will tell you how much insurance you need for your car at the very least. It’s important to remember that even if your state doesn’t mandate extensive insurance, extra coverage may be worthwhile. After all, no one wants to be saddled with tens of thousands of dollars in costs as a result of a car accident.

Let’s look at how to figure out what kind of insurance you need.

Types of Insurance Coverage

Health Insurance

Compare Health Insurance Polices. Get the best coverage.

Home Insurance

We have compared a number of the lowest priced and affordable home insurance.

Auto Insurance

Auto insurance which you can get in a few minutes. You can be covered today.

Cheap Insurance Coverage

Find insurance that best meets your needs. Get a free quote.

Complete Insurance coverage will protect your belongings. Check your insurance contract. Insurance may even be required by your state!

Give Us a call or enter your zip code and we will give you a quote immediately. You will have an opportunity to by a low cost rental policy and put it in force today.